TRILYNNS CAPITAL HOLDINGS

Trilynns Capital Holdings (TCH) is a real estate investment and asset management firm specializing in luxury vacation rentals and long-term single-family homes across the U.S. and Caribbean, delivering exceptional experiences and robust returns. Our portfolio encompasses premium vacation rentals and long-term single-family homes across the United States and the Caribbean Islands. Our primary focus is curating an exceptional collection of upscale vacation properties, including beachfront condominiums, townhomes, and villas in sought-after locations. These properties offer discerning travelers unparalleled experiences while providing robust income streams for our investors. Complementing our vacation rentals, we maintain a portfolio of long-term single-family residences. This diversified approach aims to deliver consistent income and long-term capital appreciation, balancing short-term gains with stable, long-term value growth for our shareholders and partners

Our approach

We specialize in acquiring premium residential properties in sought-after destinations across the United States and Caribbean Islands. Our portfolio features an exquisite collection of beachfront condominiums, sophisticated townhomes, and exclusive villas, meticulously selected to maximize rental potential and deliver exceptional guest experiences. By leveraging multiple rental channels and implementing sophisticated property management strategies, we transform these properties into high-performing, income-generating asset

Strategic Risk Management

We prioritize the security of our investments through comprehensive due diligence, robust screening processes, and strategic insurance practices. This disciplined approach is applied across all our investment strategies, including vacation rentals, single-family rentals, angel investing, and short-term real estate note investments.

Long-term Single-Family Residences

Complementing our vacation rental holdings, we maintain a robust portfolio of single-family residential properties strategically positioned in dynamic markets across the United States. Our long-term residential investments are carefully chosen to provide stable income streams and potential for significant capital appreciation. Through disciplined market research and expert asset selection, we create a resilient investment approach that balances immediate returns with sustained long-term growth.

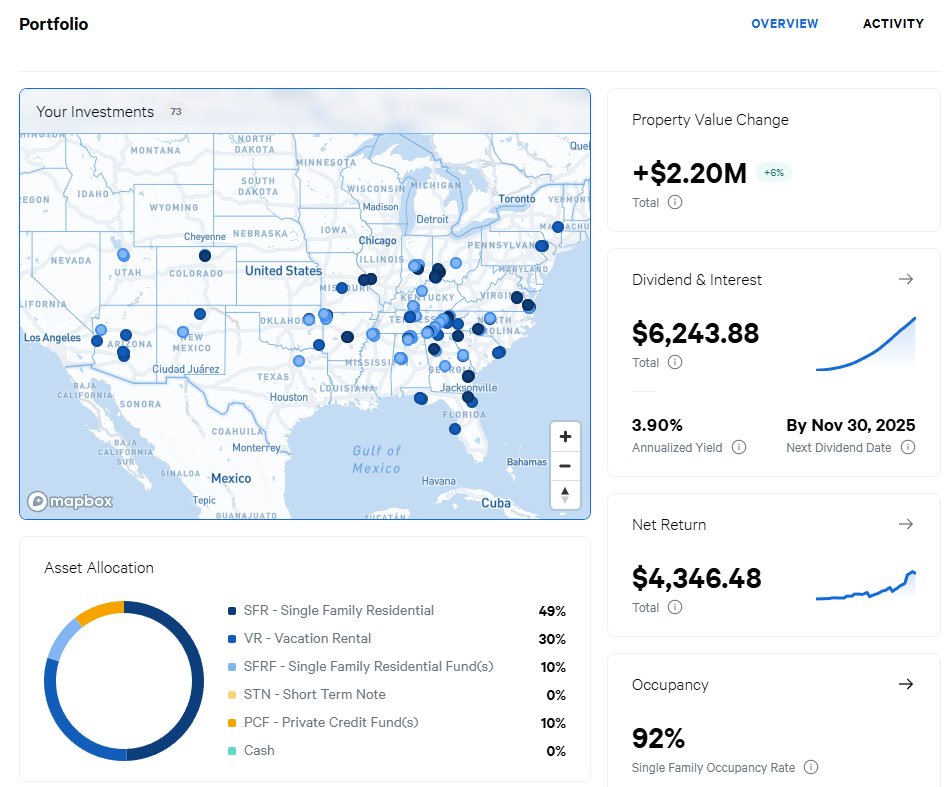

PORTFOLIO SNAPSHOT

Single Family Residential

Currently invest and own 30 propertiesVacation Rental

17 Vacation RentalResidential Fund

Own 34 UnitsPrivate Credit Fund

Invested $20,0000Short Term Note

Interdum eget eleifend